[ad_1]

That would clarify quite a bit. He’s not very efficient at a lot, however he’s efficient at setting the preconditions for a recession. From Yahoo!Finance quoting the Kobeissi Letter:

“In a way, President Trump may actually want a recession,” the put up says. “A recession achieves most of Trump’s economic goals at once,” referring to his marketing campaign guarantees of low inflation, treasury yields, a discount in commerce deficits, a fee reduce by the Federal Reserve, and decrease oil costs.

As I’ve mentioned earlier than, it’s exhausting for tariffs (a microeconomic software, with generally macro penalties) to considerably cut back the commerce deficit particularly when overseas nations can retaliate.

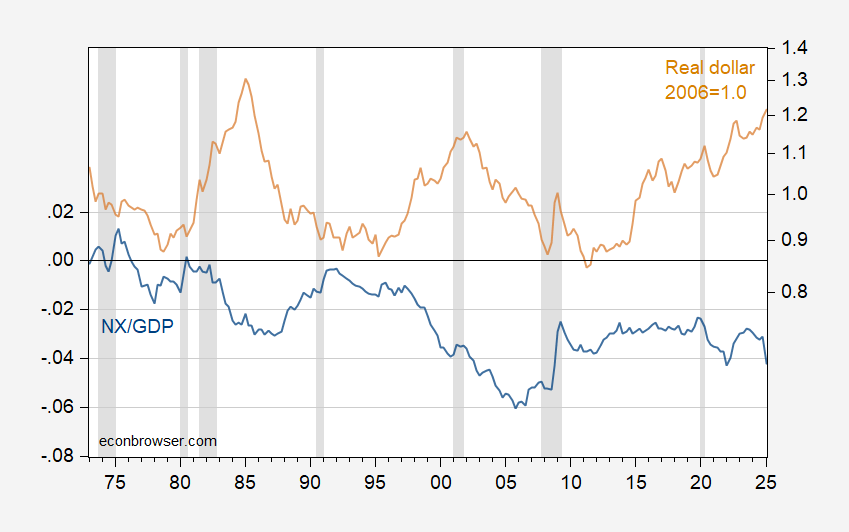

I questioned, then, what it could take to get the commerce deficit to zero, by the use of change fee depreciation or recession (or, expenditure switching vs. expenditure discount). Consider the next graph.

Figure 1: Net exports to GDP (blue, left scale), and actual worth of US greenback, 2006M01=1 (tan, proper log scale). NBER outlined peak-to-trough recession dates shaded grey. Source: BEA 2025Q1 second launch, Federal Reserve, and NBER.

Note that some observers have indicated 20-30% as an inexpensive quantity. One of these is Peter Hooper who on the Fed coauthored a well-known paper on commerce elasticities; nevertheless, I feel the 20-30% determine is a quantity which includes different results moreover simply the relative value results).

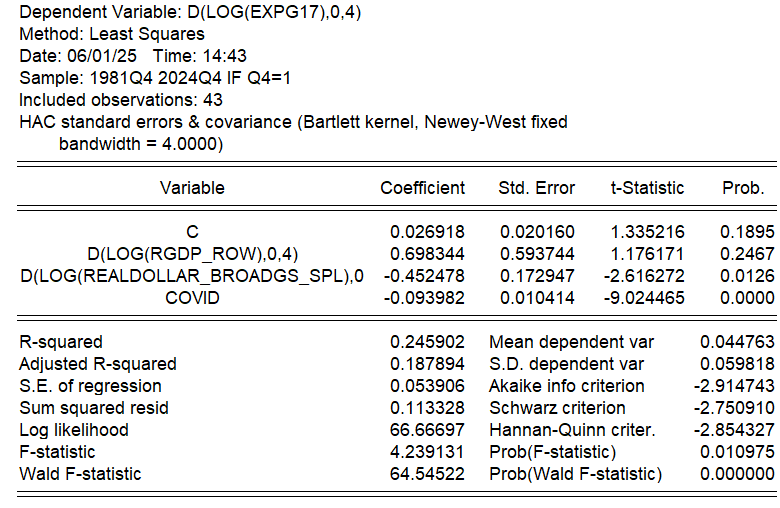

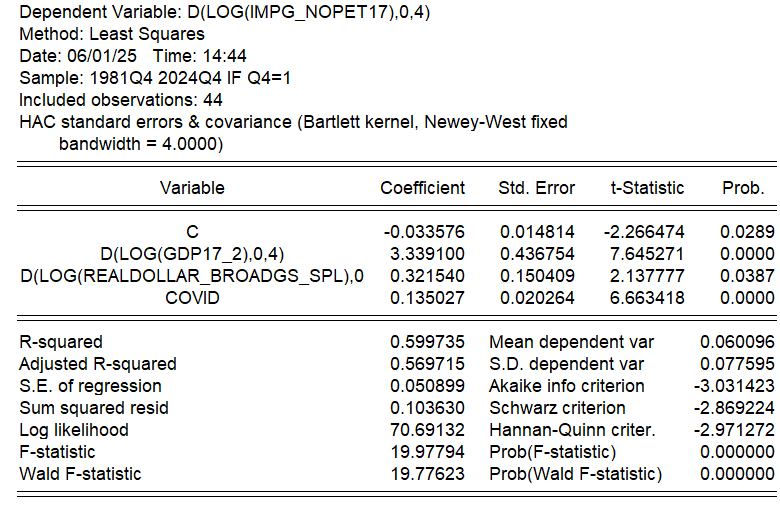

In order to reply the query of required depreciation, we’d like elasticity estimates. Without going into intensive calculations, I obtained some again of the envelope estimates (for extra detailed analyses, however on older information, see right here).

These are regressions of y/y development charges, non-overlapping (sampled at This autumn) for items exports on rest-of-world US export weighted GDP and actual worth of greenback, and for non-oil items imports on US GDP and actual worth of the greenback, together with a Covid dummy (imports, exports, GDP in actual phrases).

Confirming my earlier estimates, export value elasticities are greater than non-oil import value elasticities, and import earnings elasticity may be very excessive.

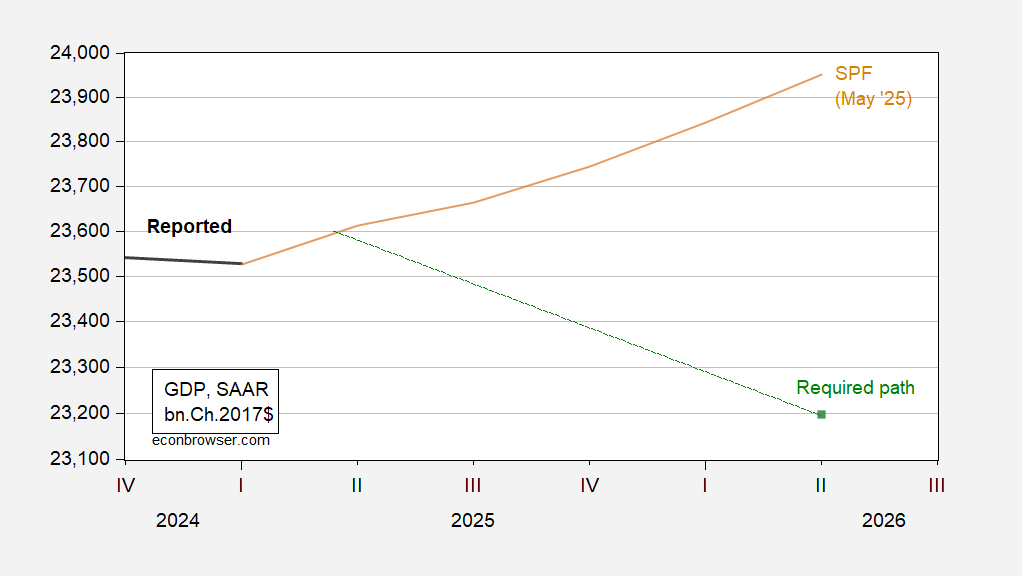

Using these estimates, I conduct again of the envelope calculations to see what modifications are wanted for an elimination of the 1053 bn Ch.2017$ discount the online export deficit (2024Q4 numbers).

By my calculations, a 20% actual depreciation of the greenback solely will get one a few third of the way in which (326 bn), whereas a 1.4% discount in GDP relative to development will zero out the commerce deficit, assuming the rest-of-the-world doesn’t expertise any decline (in order that US exports are secure). While 1.4% doesn’t sound like a big quantity, given a baseline development fee of 1.8%, this means a few 3.2% decline relative to baseline.

Using the SPF forecast, this means GDP must be 23197 vs 23952 in 2026Q2.

Figure 2: GDP (daring black), SPF May forecast (tan), and stage of GDP essential to stability actual internet exports (inexperienced sq.), all in bn.Ch.2017$ SAAR. Source: BEA 2025Q1 second launch, Philadelphia Fed, and creator’s calculations.

By the way in which, how can one get a greenback depreciation? Lowering rates of interest (which might spur mixture demand, tending to extend imports), destroying confidence within the greenback as a secure haven (been there, finished that…however I suppose the Trump administration might do extra), or drive overseas nations to understand their foreign money (e.g., China, Korea, Taiwan). Not positive that’s possible, however I’m positive the Trump staff will do their darndest.

[ad_2]